Comparing real estate metrics from one year to another can be challenging, especially in a dynamic housing market like Bel Marin Keys. Factors such as market variability and unpredictable events can make such comparisons less meaningful or accurate. In recent years, the real estate landscape experienced unprecedented changes, primarily driven by the pandemic. The demand for homes skyrocketed as buyers sought properties with home offices and spacious backyards. First-time and second-home buyers flooded the market, taking advantage of historically low mortgage rates and the forbearance plan, which reduced foreclosures significantly. This surge in demand created a market reminiscent of a rare and elusive creature—a ‘unicorn’ year. However, as the market gradually returns to normal, it’s essential to reassess our comparisons and expectations, especially within the Bel Marin Keys neighborhood in Novato, CA.

The Shift from ‘Unicorn’ Years:

Comparing the current market to the ‘unicorn’ years is no longer an accurate benchmark. Let’s delve into three key factors that highlight this shift and emphasize the need for a new perspective tailored to Bel Marin Keys.

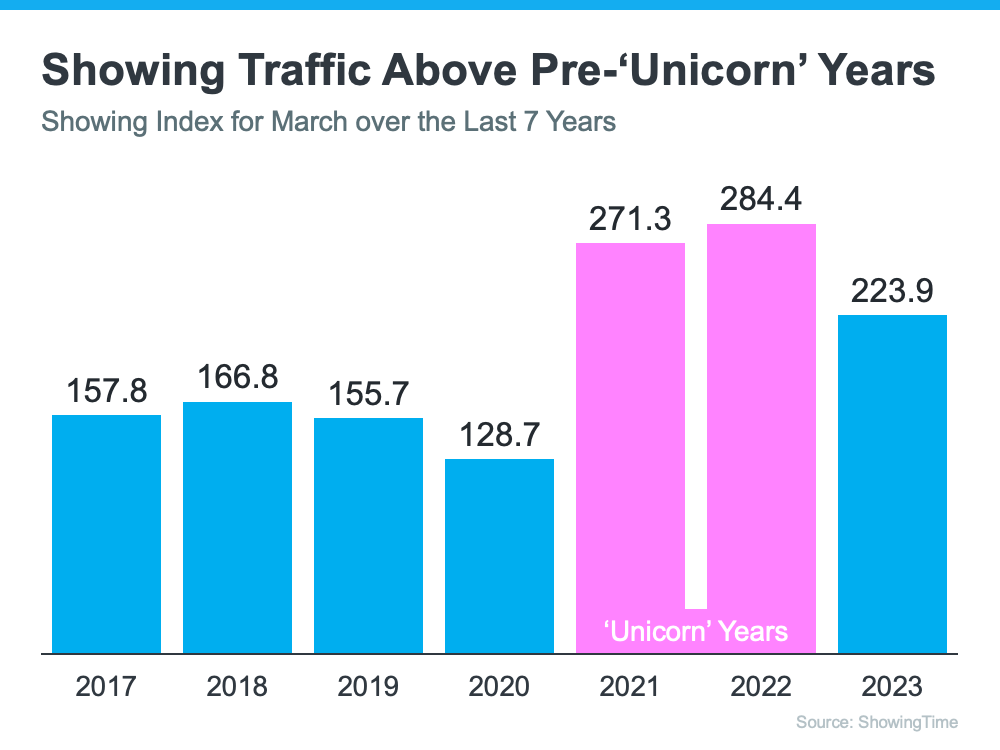

1.Buyer Demand:

Contrary to popular belief, buyers are not scarce in Bel Marin Keys. While the demand may have decreased from the peak of the ‘unicorn’ years, it remains robust compared to the more typical years of 2017-2019. In fact, our neighborhood has witnessed multiple offers on nearly every recent listing, demonstrating the high level of buyer interest. This strong demand far surpasses the limited inventory available in Bel Marin Keys, creating a competitive market. According to ShowingTime data (see graph below), buyer activity in our area has consistently shown strength:

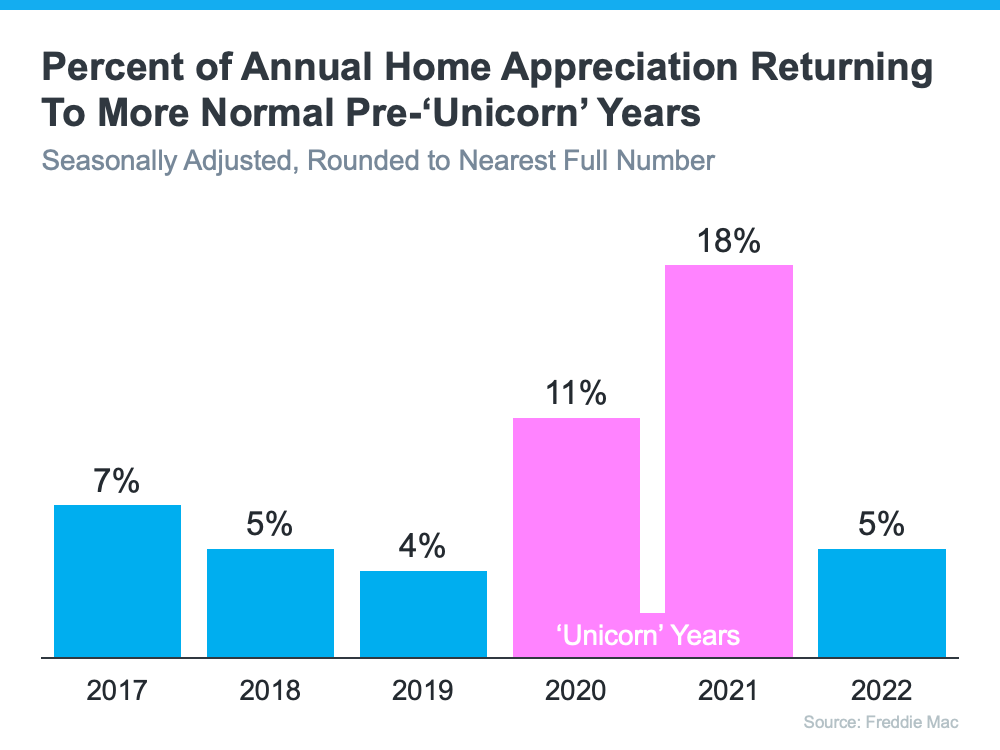

2. Rising Home Prices:

It is crucial to avoid comparing today’s home price increases with the extraordinary growth witnessed in the previous couple of years. While 2020 and 2021 experienced historic appreciation numbers nationwide, it’s essential to focus on the local trends in Bel Marin Keys. As we examine the data, it becomes evident that our neighborhood is experiencing an aggressive climb in prices once again. In fact, based on our latest market report, Bel Marin Keys has seen a significant shortage of inventory this year, resulting in a 34% price decline from its peak last April. However, year to date in 2023, prices have already increased by 21% and continue to rise towards historic highs. It’s important to note that real estate is hyper-local, and our team at Journey Real Estate specializes in providing insights into the specific trends within the Bay Area.

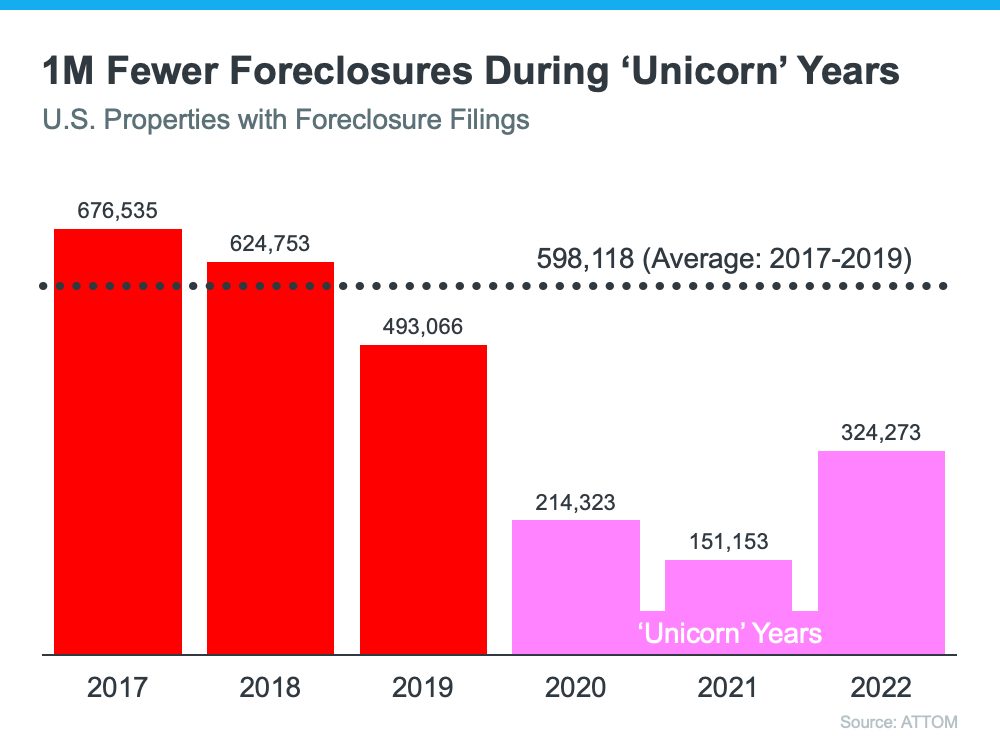

3.Foreclosures:

While headlines about increasing foreclosure filings may cause concerns, it’s essential to consider the context within Bel Marin Keys. The percentage increases in foreclosure filings are based on historically low rates. With the end of the foreclosure moratorium, it’s expected that foreclosure numbers will rise compared to the last three years. However, it’s crucial to emphasize that these figures align with the normal filings observed during 2017-2019. Clickbait headlines that compare recent numbers to when foreclosures were non-existent can create unnecessary alarm. ATTOM, a property data provider, offers a graph (shown below) that puts the current situation into perspective nationally:

Conclusion:

The Bel Marin Keys real estate market is undergoing significant changes, driven by rising prices and limited inventory. As the ‘unicorn’ years fade into the past, it is crucial to navigate these shifts with an informed perspective. At Journey Real Estate, our goal is to clarify rather than terrify, and we specialize in providing insights and support for all your real estate needs in Marin County, CA and the surrounding Bay Area. For expert guidance in navigating the Bel Marin Keys market, contact Corey Robinson at 415-858-9469 or corey@thejourneyre.com. We are here to assist you in making informed decisions and achieving your real estate goals.

Please let me know if there’s anything else I can help you with!